Product Description

Free Trials involve an incredible amount of time and support! Regretfully, spare time seems to be an extremely scares commodity!! As an Alternative, I’m offering this monthly subscription service as a Low Risk Means to Test For Yourself, before you Purchase!!!

Any Time in the First 30 Days!!

“You Like What You See”!!!!

“Would Like to Purchase”!!!

Your Initial Subscription Fee Will Be Discounted from the price of the Product being Purchased!!!

If at Any Time, for Whatever Reason.. You’d rather not continue or purchase at that time.. No Worries at All.. Just cancel the subscription, uninstall the product when it expires, and all your out is a small nominal fee to help cover my time and support.

I believe this to be a fair compromise.. I don’t end up wasting my time with thousands of people just searching for the next Freebies, and You’ll Never Spend a lot of money (not that my products are expensive) on something you might end up not wanting after all..

——————————————————————————————————————————————————–

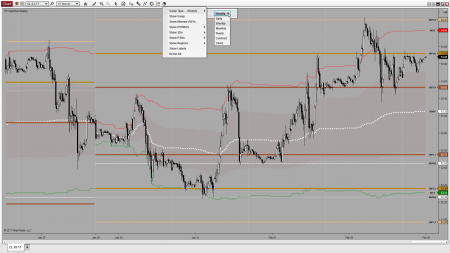

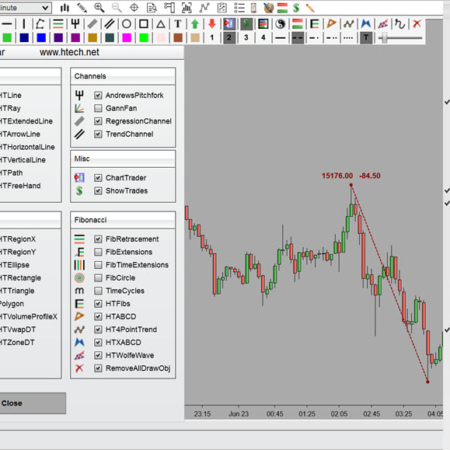

VWAP Plus | Volume Weighted Average Price | Support – Resistance | Technical Analysis | NinjaTrader 8 | Indicator

Volume-Weighted Average Price (VWAP) is the ratio of volume traded at price, to the total volume traded, over a particular time horizon. In finance, every single Transaction (Trade/Tick/Pip), of any given Product (Stocks/Futures/Forex) consists of three elements. The “Volume” (Quantity) of whatever it is being bought or sold, along with the “Price” and “Time” at which that took place. VWAP is calculated by adding up the sum of (price multiplied by volume) for every transaction (transaction price multiplied by the total volume traded of that transaction price), then dividing that by the overall total volume traded for the period of time your measuring.

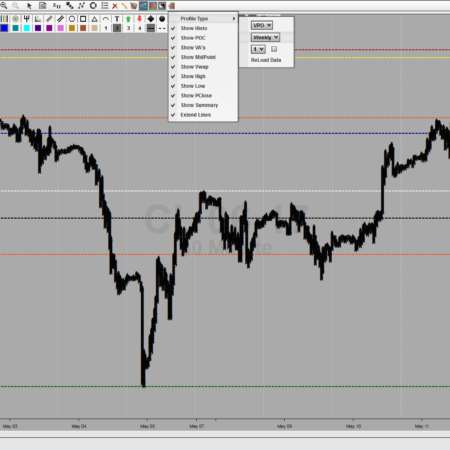

7 User Configurable VWAP Session Period Types:

- Daily

- Weekly

- Monthly

- Yearly

- Chart

- Contract

- User Specified

17 Unique Current and Previous Session Value Plots

Current Session Developing Plots:

•Volume Weighted Average Price (VWAP)

•3 Unique Upper and Lower Standard Deviations of VWAP

Previous Session Plots:

•1 Session Prior Volume Weighted Average Price (VWAP1)

•3 Unique Upper and Lower Standard Deviations of Previous VWAP1

•2 Session Prior Volume Weighted Average Price (VWAP2)

•3 Session Prior Volume Weighted Average Price (VWAP3)

•Missed/Naked Previous VWAP’s (coming soon)

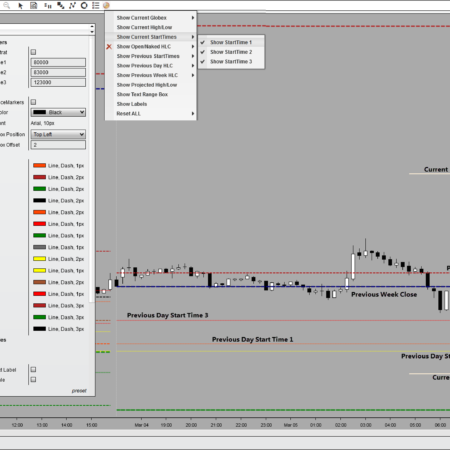

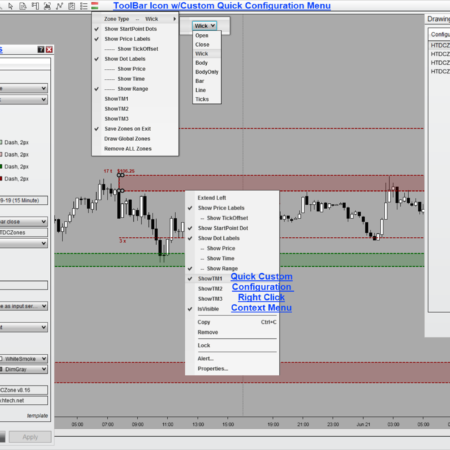

ALL Plots Can be Quickly Hidden (INDIVIDUALLY and/or Altogether)

with a Single Click of the Mouse (thru dropDown Icon placed in NT’s ToolBar)

– ALL Plot Colors and Styles are Completely User Configurable!

– ToolBar DropDown Icon for Easy User Selectable Options and Adjustments Without Chart Refresh.

Quit Using Indicators that display different values on every chart your looking at!

VWAP Values/Plots Remain Consistent (Are the Exact Same) Across Every DataSeries!

So You Accurately Display and Trade Off of The Exact Same Values On All Your Charts!

VWAP is often used as a trading benchmark by investors who aim to be as passive as possible in their execution. Many pension and mutual funds fall into this category. The aim of using a VWAP is to ensure that the trader executing the order does so in-line with volume on the market.

VWAP is also often used in algorithmic trading. Indeed, a broker may guarantee execution of an order at the VWAP and have a computer program enter the orders into the market in order to earn the trader’s commission and create P&L. This is called a guaranteed VWAP execution.

The broker can also trade in a best effort way and answer to the client the realized price. This is called a VWAP target execution; it incurs more dispersion in the answered price compared to the VWAP price for the client but a lower received/paid commission. Trading algorithms that use VWAP as a target belong to a class of algorithms known as volume participation algorithms.

Please Click on Video Tab to Watch a Recorded Product Demonstration!

Minimum Requirements – NinjaTrader 8.0.4